Need a better understanding of Long Term Care Insurance?

LTCI provides coverage for a person who has a chronic problem and needs help with their activities of daily living (ADL’s – bathing, dressing, toileting, transferring, continence and eating) or has a cognitive impairment, such as Alzheimer’s or Dementia. Health Insurance and Medicare will not pay for chronic care. Long Term Care policies help cover the cost of Home Health Care, Assisted Living facilities, Skilled Nursing facilities and Adult Day Care. It also provides other benefits such as Respite care, Geriatric Care Management services and more.

Gordon Associates’s mission is to bring our clients current, accurate information. Here are a few long term care insurance facts and stats you should know.

- The need is likely – 70% of people over age 65 will need some form of long term care.¹-¹

- It can be expensive – the average cost of an assisted living facility is $51,600. The average cost of a home health aide is $54,912 (for 44 hours per week). The average cost of a semi-private room in a nursing home is $93,072. The average cost of a private room is $105,852. These costs will vary depending on where you live.¹-²

- Family members aren’t free – even if a family member provides you with long term care, there is still a cost. Caregiving can take a significant physical and emotional toll on loved ones.

- You have to qualify to receive benefits – you have to demonstrate that you are unable to perform at least 2 of the 6 Activities of Daily Living (ADLs) – bathing, dressing, eating, transferring, toileting, and continence. You may also qualify for benefits if you are diagnosed with Alzheimer’s or cognitive impairment by a qualified professional.

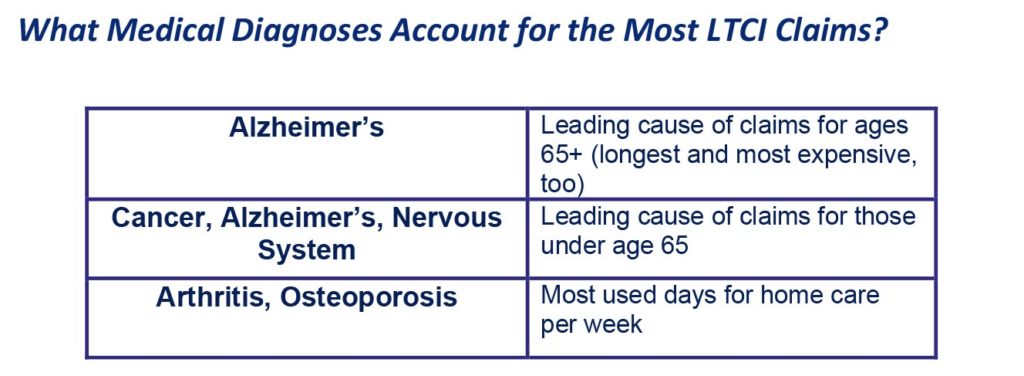

- There are a few big causes – Alzheimer’s disease is the leading cause of Long Term Care Insurance claims for people age 65 and older. Cancer, Alzheimer’s disease and nervous system disorders are the leading cause of claims for people younger than age 65.

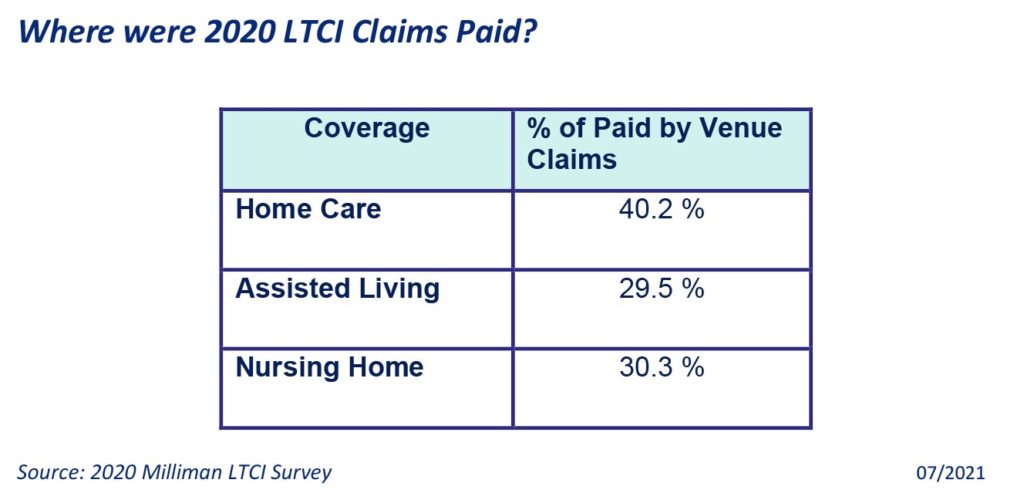

- Benefits are flexible – Long Term Care Insurance provides care at home, assisted living facilities and skilled nursing homes. When people first start receiving benefits, over 40.2% of those claims are for home care. 2_1

- Benefits can be paid to family members – certain Long Term Care Insurance policies allow you to pay benefits to adult family members who care for you. This need is growing, particularly for adult family members who also work. A 2022 study highlighted that about 70% of them fear having to quit in order to keep caring for their adult parent.

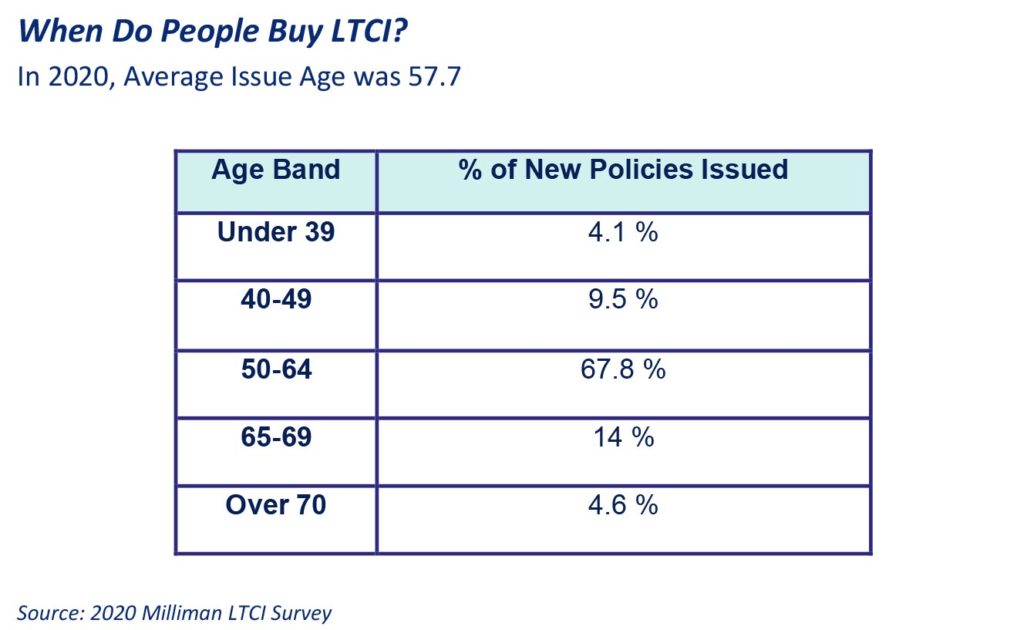

- 57.8% of standalone long term care insurance policies were issued and placed. 2_2

At Gordon Associates we educate our clients and advisors on both Stand-Alone “Traditional” LTCI and Hybrid Asset-Based Life/LTCI because we don’t believe one-size fits all when it comes to Long Term Care Insurance.

For more information, request our Consumer Guide

You’ll find the answers below, but that’s just the beginning. We recently put together an at-a-glance summary of 2021 LTCI Facts & Stats, drawing from a range of credible industry sources. Provide us your email address so we can send you the information.

In this industry, there’s always more information to learn, and it’s our honor to share it with you. As always, if you need assistance, please contact us, or call 800-533-6242.

Sharpen your LTCI IQ: request our 2021 LTCI Facts & Stats!

[1-1] U.S. Department of Health and Human Services

[1-2] Genworth’s 2020 Cost of Care Survey

[2-1] 2020 Millman LTCI Survey

[2-2] 2020 Millman LTCI Survey

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about LTC and assist you with your health care planning.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about LTC and assist you with your health care planning. To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about tax breaks and incentives for LTCI for federal and state taxes.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about tax breaks and incentives for LTCI for federal and state taxes.