Everyone’s talking about inflation here in 2022. From food prices to energy costs, you’re not alone if your budget doesn’t stretch quite as far as it used to. Knowing how to cope with inflation in long term care costs can help protect your future and stretch your budget.

Inflation Isn’t New–But That Doesn’t Mean Planning is Easy

While the current level of inflation is uncommon, inflation itself isn’t new. In fact, we’ll likely be dealing with inflation (in varying degrees of severity and steepness) for years to come. When inflation runs hot, it may become challenging to predict where prices will be next year or next month–much less a decade into the future.

Which means that when you’re planning for long term care costs, you may need to put a little extra thought into your strategy. Long Term Care Insurance can provide a valuable hedge against rising costs–and let you feel more confident in your future.

An Inflation Case Study

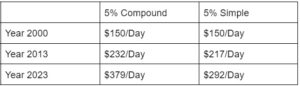

Let’s start with a simple sounding case study. An accountant (Ben) and a teacher (Leslie) have been married for years. Over twenty years ago, Ben purchased Long Term Care Insurance. When he purchased the policy (way back in the year 2000 with an initial benefit of $150/Day), he had two plan options with regard to inflation protection:

- Plan 1: had a 5% simple inflation rate.

- Plan 2: had a 5% compound inflation rate.

Simple inflation vs. compound was the only difference in the plans. In real life, inflation compounds on itself. For example, if a loaf of bread costs $5.00 and inflation is 5%, next year that bread will cost $5.25. If inflation is 5% again, then the year after it will cost $5.51. That’s real life.

Simple inflation doesn’t mirror real life. That loaf of bread will cost $5.25 after the first year, but in the second year it would cost $5.50 using simple inflation. What’s the big deal with a 1 cent difference? For a loaf of bread, not much, but that difference becomes much bigger when you apply compound inflation to long term care costs over a period of years.

Plan 1 was tempting to Ben–it seems very similar to plan 2, and Ben would have saved $400 a year on his premium payments. Luckily, Ben was an accountant and knew how valuable that compound inflation rate would be (you’ll see why in a second). Eventually, Ben selected Plan 2 and even added unlimited coverage to his plan.

In 2013, Ben needed to activate his policy. If Ben had gone with Plan 1, the 5% simple interest would have provided him with $217/day. But because Ben selected the compound interest option, his plan started paying out $232/day. Ben is still on his claim today and his benefit continues to grow.

In 2013 the compound inflation plan paid $5,475 more in benefits than the simple inflation plan would have. In 2023 it will pay out $31,755 more!

How to Prepare for Rising Costs

So, this little anecdote makes for a great case study. There are lots of ways this scenario could have gone right–and could have gone wrong. Ben was an accountant–and so maybe he had a hunch that compound inflation would have an easier time keeping up with real-life inflation. But even then, it’s hard to accurately predict what long term care costs will be ten or fifteen or twenty years from now.

That’s why it’s useful to have a plan. And there are a couple of ways you can fold unpredictability into your own long term care plans:

- Have multiple ways to pay for your long term care lined up. For example, you could couple your LTCI with some self-funded sources. The idea is to have multiple lines of revenue you can tap into if things get dicey.

- Invest in Long Term Care Insurance: LTCI is a great way to hedge your bets and protect yourself against costs you can’t totally predict. Trying to access long term care without LTCI can be complicated–and expensive.

- Keep an open mind: Look at all the options on the table when it comes to Long Term Care Insurance. There are several different types of plans (some with compound rates, some with simple–some tied to life insurance, some not). Be sure to plan rationally–usually that means planning on living a long time and strategizing accordingly.

Getting Used to Inflation

Will inflation continue to be as turbulent and chaotic as it is right at this moment? Probably not. But are prices going to come back down? Also probably not. At least, not for everything–and that’s almost certainly the case for long term care. (In fact, the costs of long term care were already rising faster than inflation.) So it’s important to build that reality into your strategies as you select Long Term Care Insurance.

Here are a couple of things to look out for:

- If you can, choose compound inflation instead of simple inflation. This will help your benefits more closely track with what happens in real life.

- The best protection will come from a combination of unlimited benefits and inflation protection. Unfortunately, unlimited protection isn’t as available as it once was–so it can be challenging to find that kind of plan. However, there are plenty of carriers that offer long coverage terms ranging from 2-7 years. So instead of receiving unlimited benefits, you would start with a pool of money, which will grow over time with inflation. For example, 6 years of coverage provides approximately $325,000 pool to start and by year 20 it will have grown to over $550,000 with a 3% Compound Inflation Rider (these figures vary depending on the initial benefit you select and other factors).

- Remember that long term care costs are outpacing inflation. To be sure, the magnitude of inflation in 2022 was surprising to everyone, so no one is quite sure how that will ripple through LTCI costs moving further into the future. However, even without that–long term care costs were already rising. So factoring those rising costs into your plans will only benefit you.

To a certain degree, inflation rates will vary depending on where you live. That’s because healthcare costs can vary dramatically from state to state. Assisted living in South Dakota, for example, may cost more or less than assisted living in Virginia. This could be true of just about any long term care related costs. So talk to your financial planner about where you’re planning your retirement–and where you might need care.

Look to the Future

Ultimately, planning for long term care is about planning for the future. And because no one can accurately predict the future, we all need to hedge our bets–and plan as best we can. One of the things we can hedge against is inflation, especially if we acknowledge that the prices of today are unlikely to stay the same going into the future. When you select your Long Term Care Insurance plan, remember to plan for tomorrow.

If you need help choosing a plan, or navigating the LTCI system, contact Gordon Associates Long Term Care Planning to talk to someone from our team. We can help you feel good about your plan for the future.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about LTC and assist you with your health care planning.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about LTC and assist you with your health care planning. To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about tax breaks and incentives for LTCI for federal and state taxes.

To help determine if long-term care (LTC) insurance is right for you, we are offering a FREE informational guide. This is a comprehensive booklet that will answer many of your questions about tax breaks and incentives for LTCI for federal and state taxes.